Sub-page thumbnail

Making investments responsible and sustainable

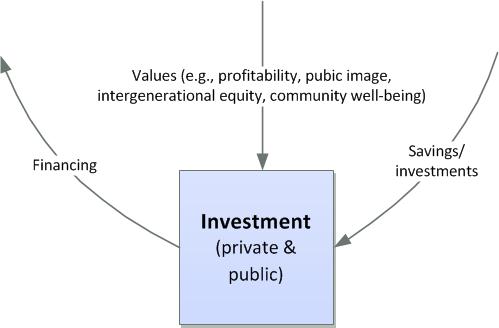

The aim of investing is to create a benefit. However, does that benefit come at the expense and possible suffering of others?

- How to ensure investments do not cause harm? Codes guiding investment practices go back to thousands of years, seen on the clay tablets of Hammurabi in ancient Mesopotamia. Public campaigns against the slave trade in the 18th century focused attention on the need to address the tragedy of morally blind investment practices and institutions. Other campaigns and social movements evolved focusing on war, labor rights, the rights of women and other civil and human rights, health and environmental issues to establish norms, laws and mechanisms addressing injustices and suffering.

- The 1960s and 1970s saw active responses to the Vietnam War, aparteid, the civil rights and women's movements, including calls for university disinvestment and the creation of faith-based and other ethical mutual funds. In spite of the opinion of neoliberal economist Milton Friedman, who in 1970 claimed that "the social responsibility of business is to increase profits," the movement to establish the field and practice socially responsible investment (SRI) continues to grow. In 1973, for example, the Interfaith Center on Corporate Responsibility was founded. Increasingly investment firms began adopting value-based screens as many businesses established corporate social responsibility (CSR) policies and practices.

- In 1984 the US Social Responsible Investment Forum (US SIF) was founded (later renamed as the US Forum for Sustainable and Responsible Investment.)

- In 2006, the United Nations launched the Principles of Responsible Investment (PRI), with the aim of integrating environmental, social and governance (ESG) issues such as climate change, human rights and environmental pollution into investment decision-making.

- The PRI then led to formation in 2009 of the Sustainable Stock Exchange (SSE) Initiative.

- In 2012, the newly formed Global Sustainable Investment Alliance (GSIA) published its first review of sustainable investments worldwide, that "13.6 trillion worth of professionally managed assets incorporate environmental, social and governance (ESG) concerns into their investment selection and management."